It’s another meeting day for the Shelby County Commission, and we have a couple of important items on the agenda.

Before we get into that, let’s check in on the coronavirus situation.

Back to Business

Today Shelby County has entered Phase 1 of the local mayors’ Back-To-Business plan, which relaxes their previous orders restricting business in an effort to slow the spread of COVID-19.

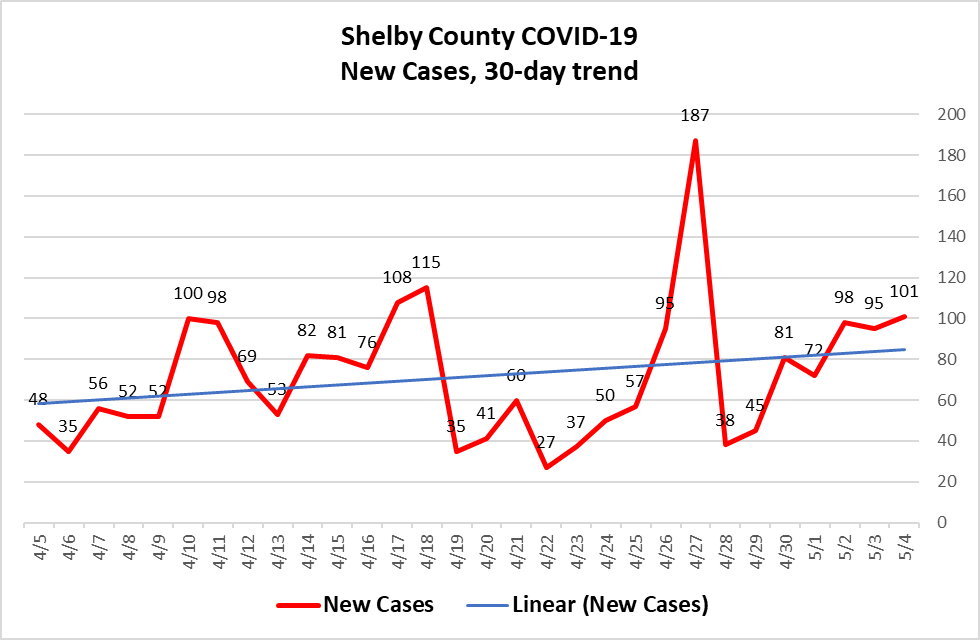

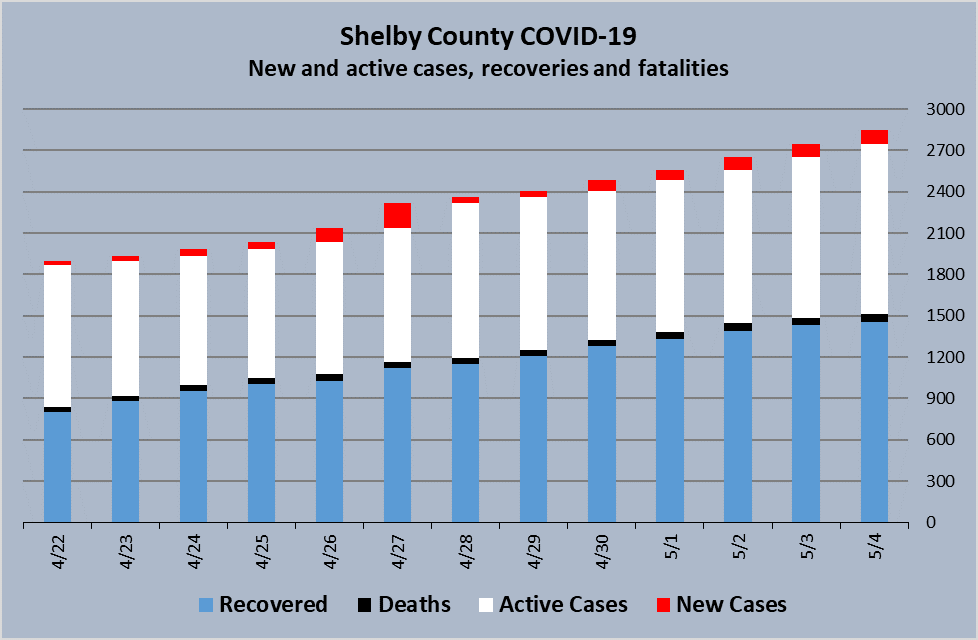

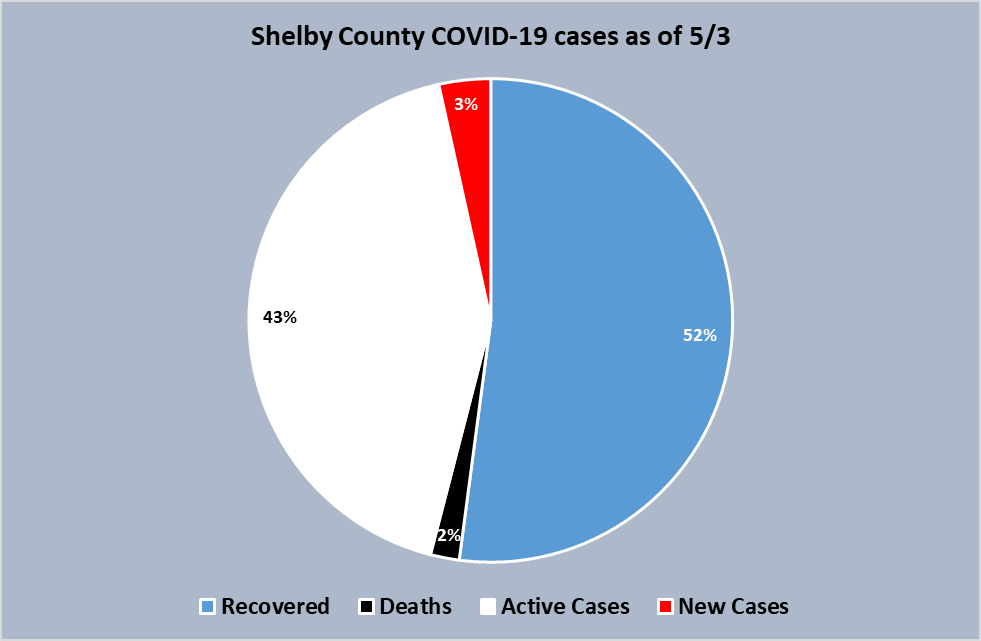

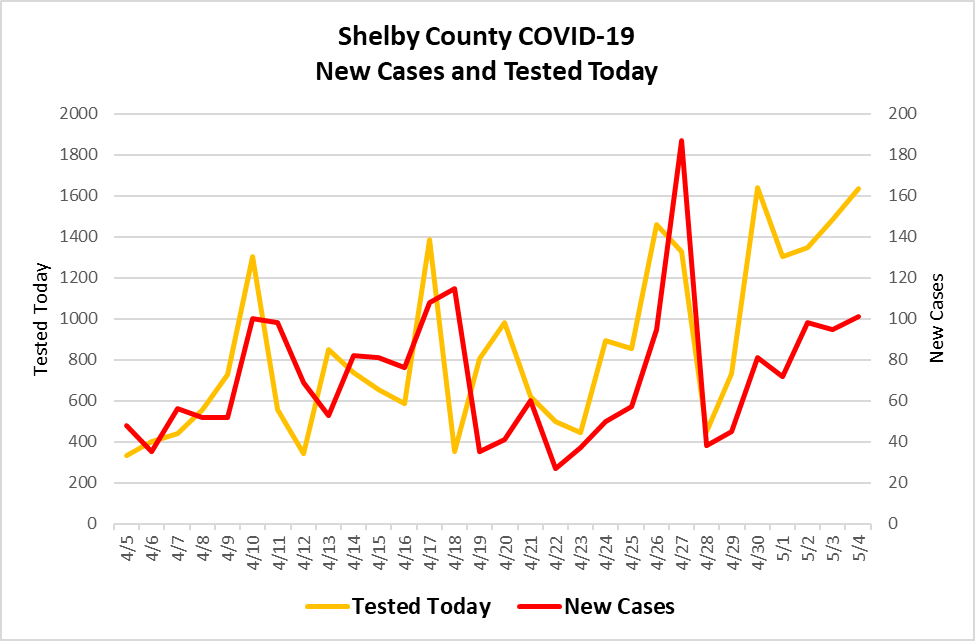

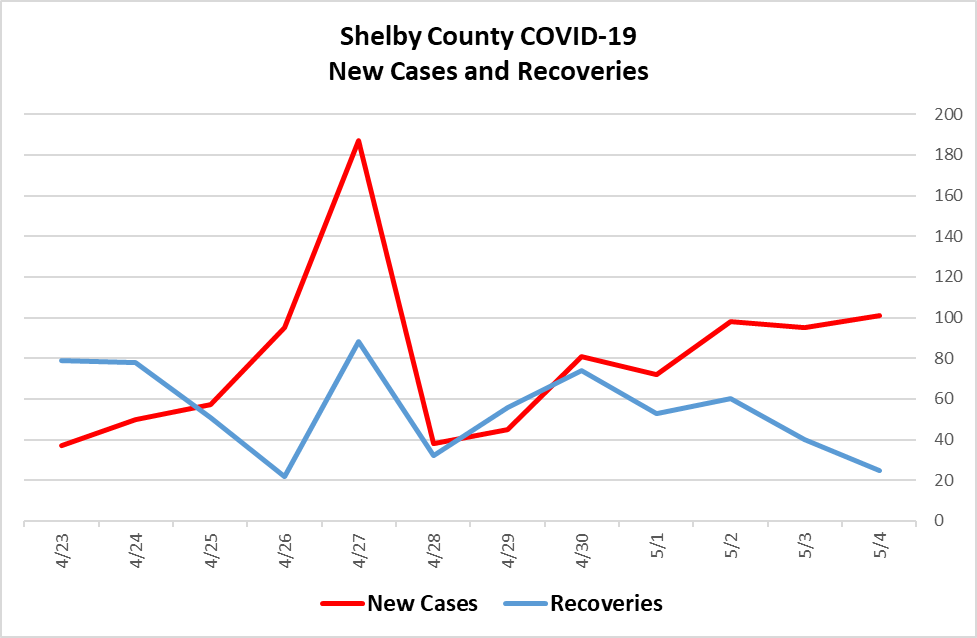

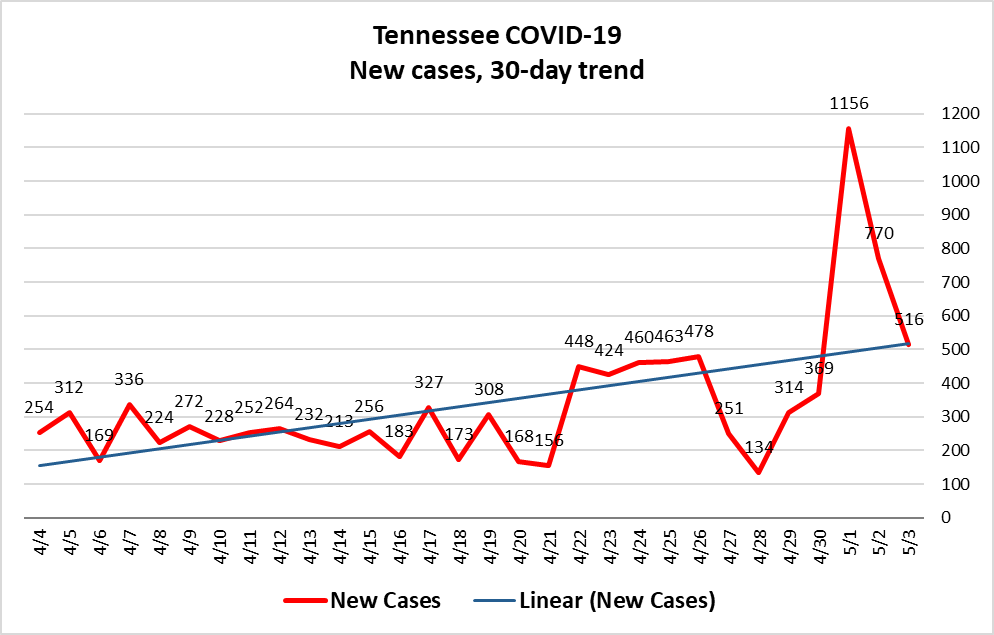

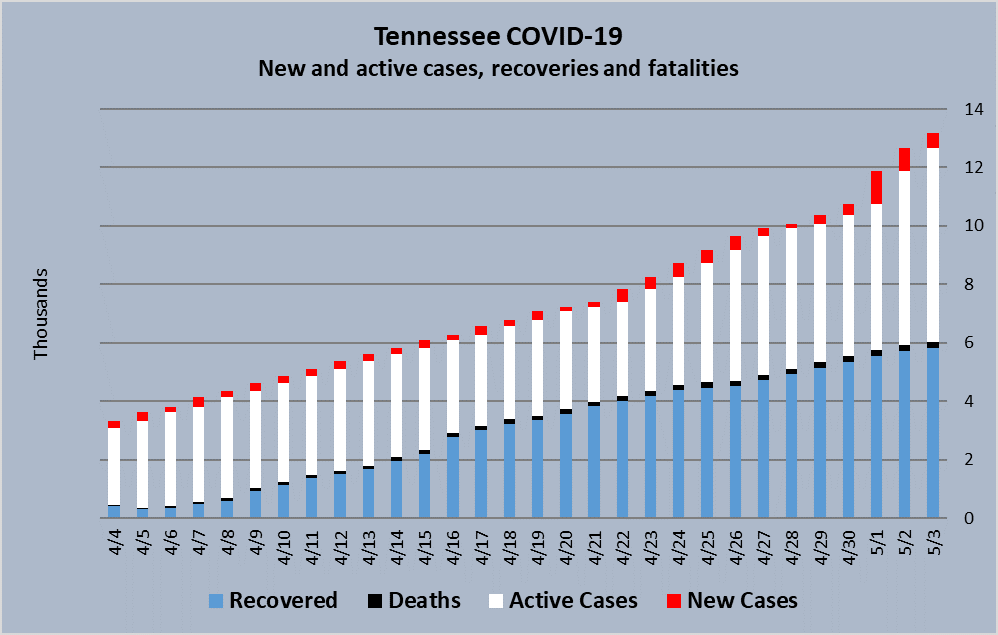

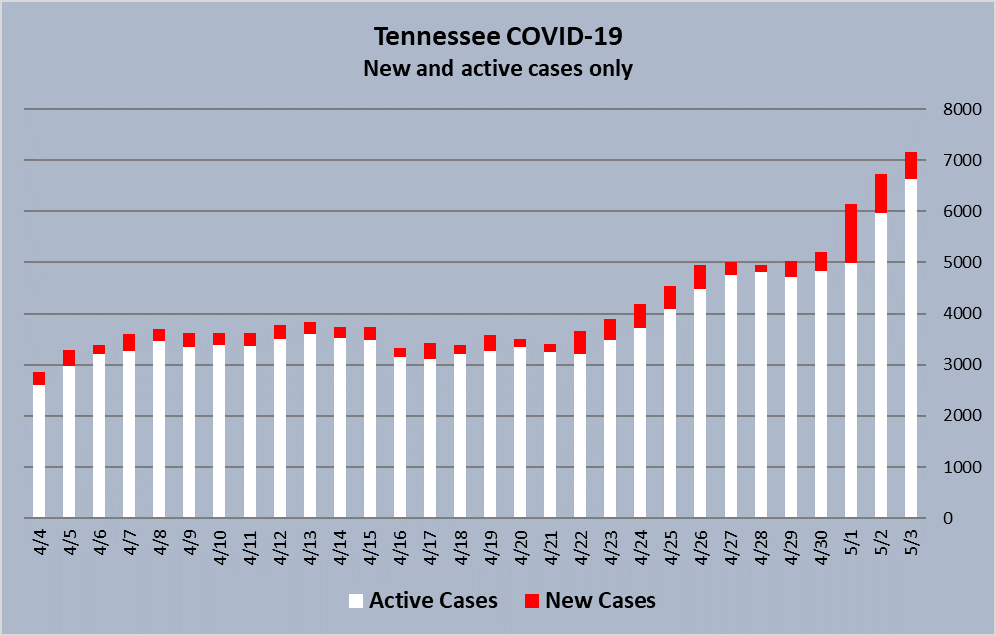

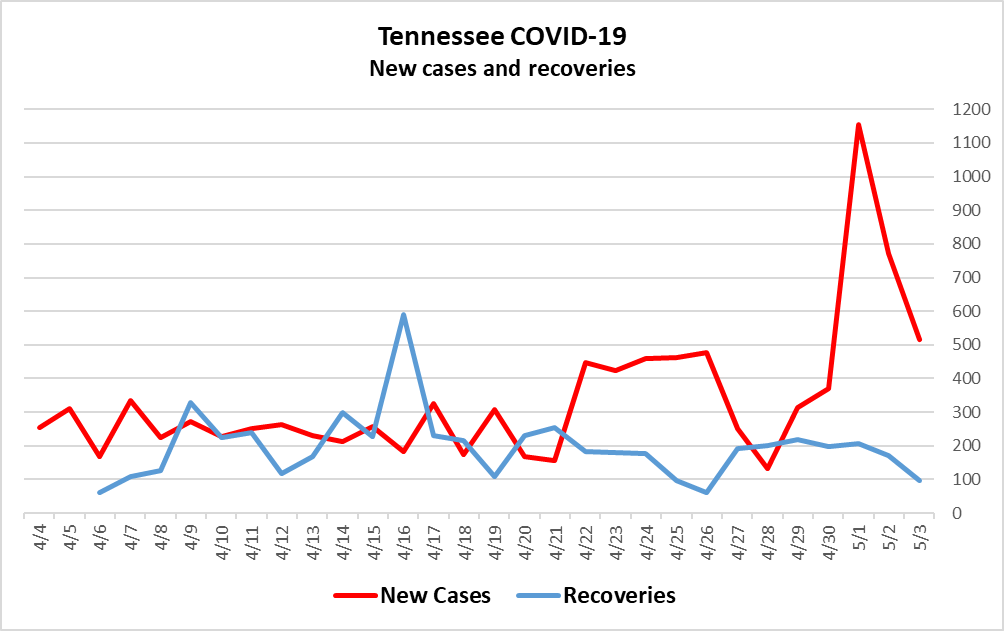

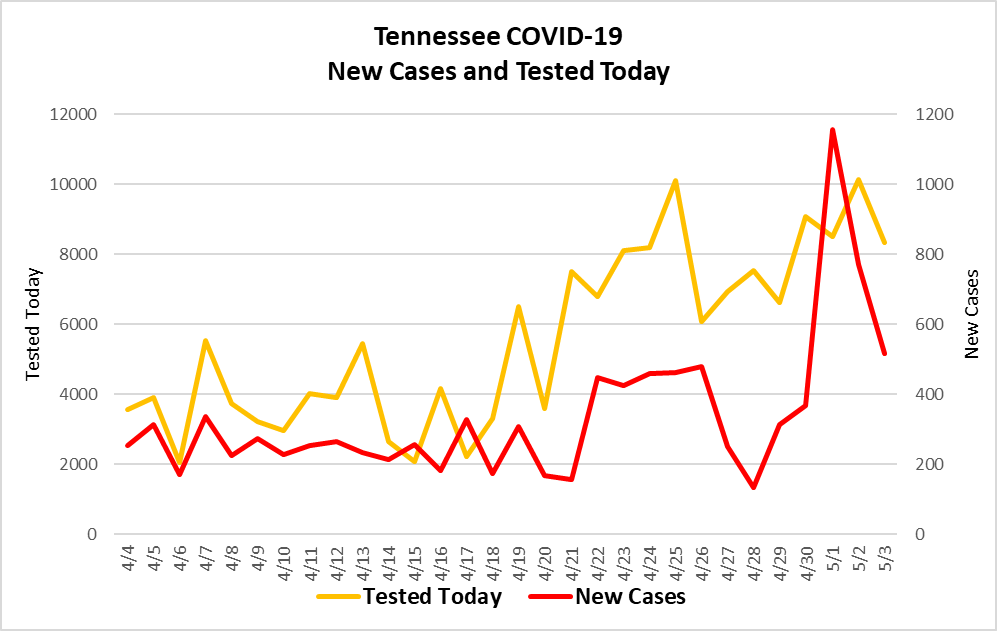

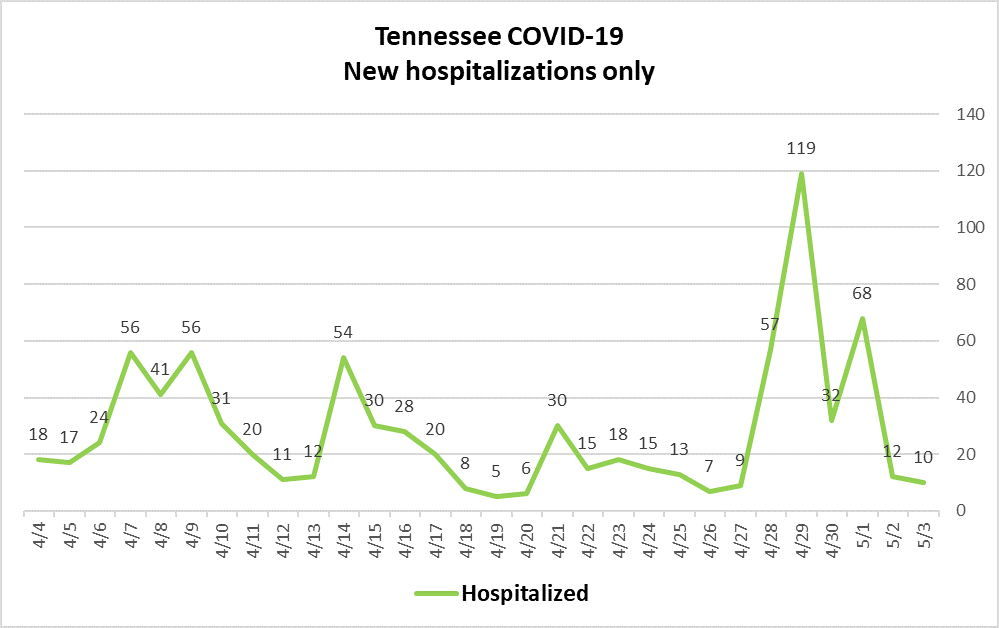

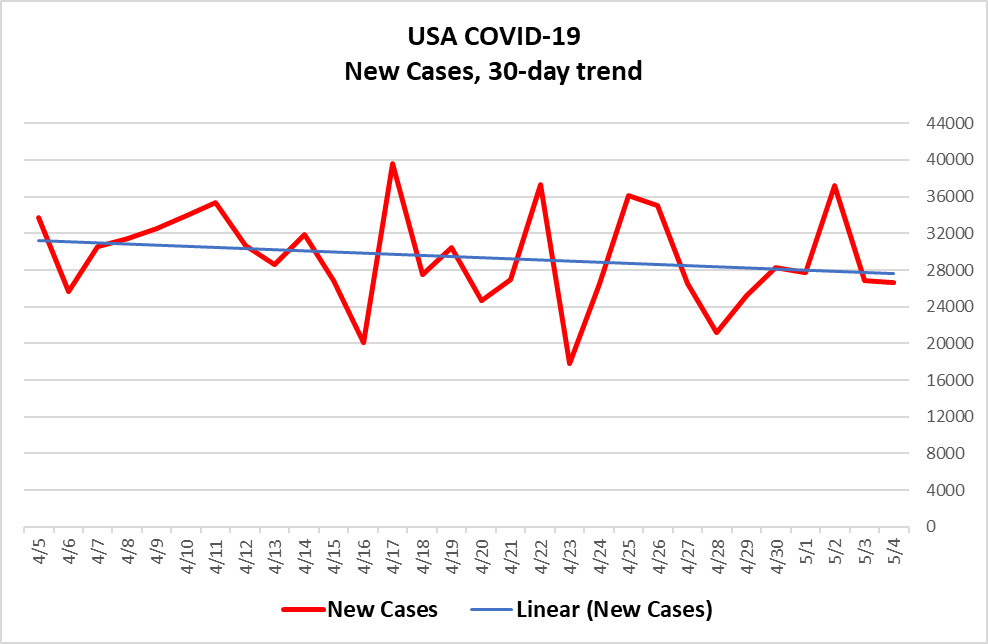

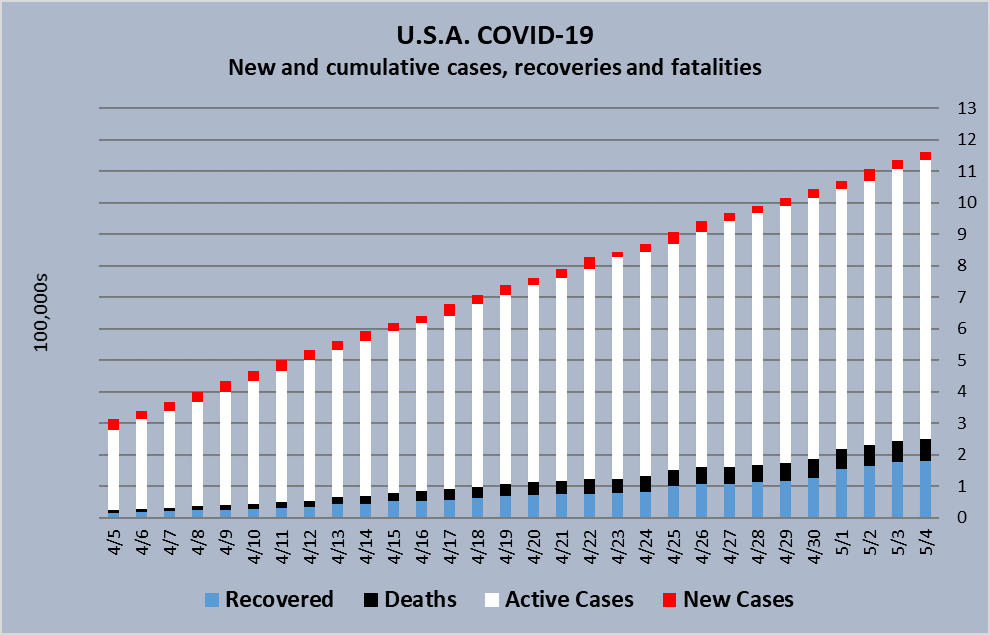

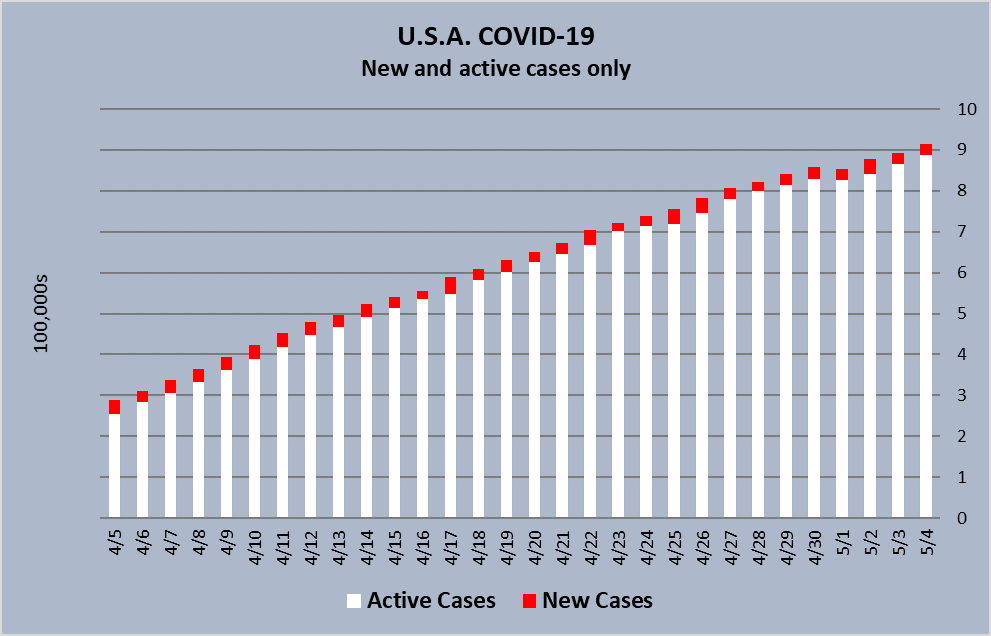

We’ve been following the numbers daily on my Facebook page, but here’s one last look at the stats as things stood while we were still fully in shutdown mode.

Shelby County

Tennessee

U.S.A.

Balancing the budget

One result of all the reduced economic activity is lower revenue projections for local government as we come to the conclusion of budget season.

Shelby County is in the same boat as other governments that are facing not only a shortfall in the current fiscal year but also lowered revenue expectations for the coming one that begins July 1.

Hits to county revenue sources such as uncollected court costs, car registration fees, and the like have reduced what is coming in. Some of these collections are at best delayed until later in the year.

And while Shelby County government does not rely as heavily on sales tax revenues as the City of Memphis and other municipalities, lowered sales tax collections will hit the bottom line of Shelby County Schools.

These and other factors have led the administration of Mayor Lee Harris to present Commissioners with a proposed budget that cuts $13 million, absorbs more than $16 million in reduced revenues and uses an additional $7.3 million from the rainy day fund. Mayor Harris also balances his proposed budget by raising an estimated $10.5 million in increased motor vehicle registration fees.

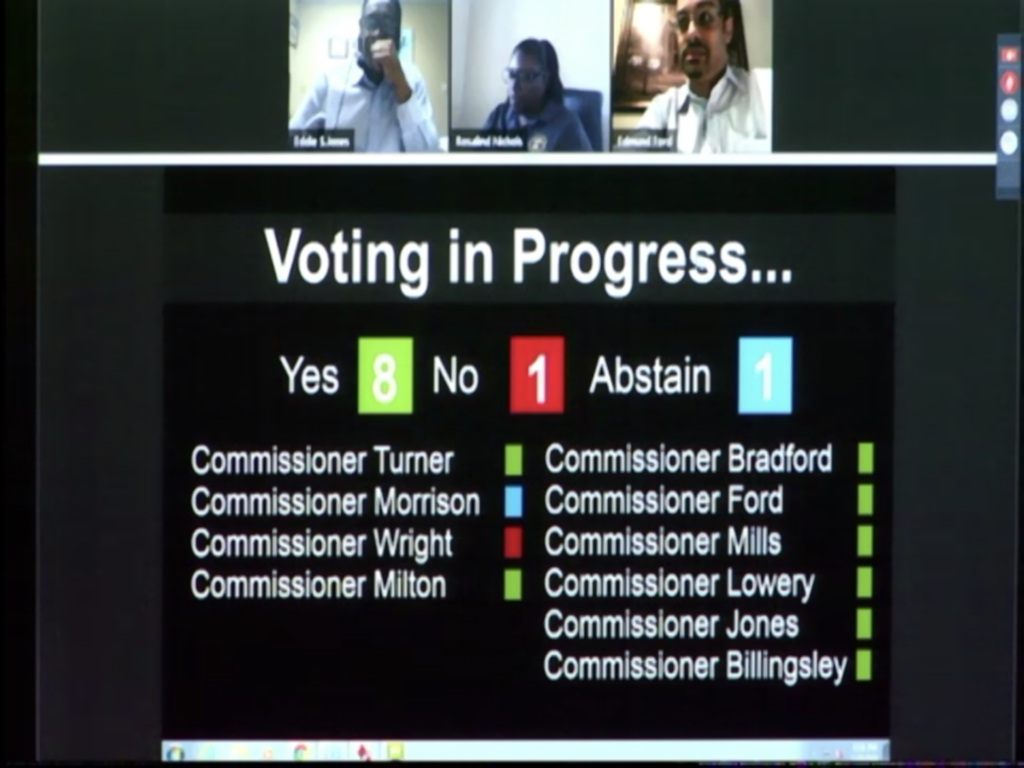

Neither side of the Harris budget has been well received by the County Commission. In two separate votes in committee on Wednesday, Commissioners rejected both the FY21 proposed budget and the wheel tax increase.

The proposed Fiscal Year 2021 budget

Following last Monday’s 7-hour budget meeting, the Commission in committee on Wednesday voted to amend and replace next year’s proposed budget with the current year budget.

We took the entire proposed budget and said, “no thanks.”

Mine was the only No vote on this amendment.

As I explained in committee, a continuing budget is fine… if you have continuing revenues. But that’s not the case.

This budget, as it stands currently, strikes $13 million in spending cuts proposed by Harris and ignores the reduced revenue projection of $16 million, creating a large budget gap while ignoring other new needs for the coming year.

The budget as amended does strike one-time expenses from FY20, but the finance department tells us that only saves about $1.5 million.

I asked one question in committee: what is the total budget amount as amended? The budget chair was unable to answer my question, and I was told they would have to figure that out by conferring later with the administration.

I believe the Commission will find a way back to a balanced budget, and possibly without a tax increase, but I find our process frustrating.

Basically what we said with this amendment was that we had to vote for it to find out what’s in it. That’s no way to do business.

Another round on the wheel tax

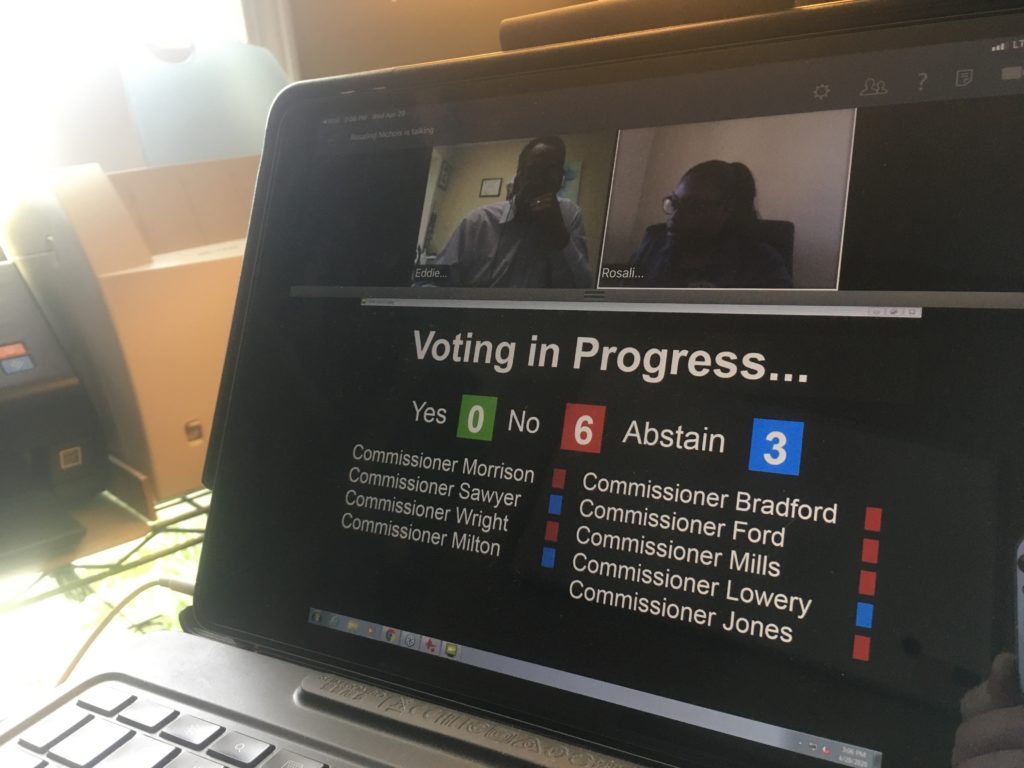

Commissioners also cast a vote on a resolution to increase the wheel tax by an additional $16.50 per vehicle.

This is separate from the two previous wheel tax increase proposals debated earlier in the year that would have gone to fund MATA.

Under the Mayor’s proposal, proceeds from this fee increase would go to education, to free up property tax revenues for other purposes.

No Commissioners voted in favor. Even the sponsor abstained.

However, this was a committee vote, and it will be heard again by the full Commission this afternoon.